Successive governments and economists have often debunked the World Bank Doing Business Index as India’s rank remained sluggish in the 130-140 range. However, on a prudent note, the present government has worked really hard to address the lacunae and the results are here to be viewed. India’s rank has moved up from 100 in the 2018 ranking to 77 in the 2018 one which is quite remarkable. How is one to view this rank?

The rank is based on a survey of industry in two cities — Mumbai and Delhi, where participants provide a feedback. This is corroborated with the processes that are involved and then tabulated. Hence two things are quite clear.

The first is that we know what it is that the World Bank is looking at and second, knowing our relative position it is possible to address the issues especially if they are within the policy ambit. Therefore, one must remember that what holds in these two cities does not hold elsewhere as things could be better or worse. Is there anything amiss in deliberately going after a rank by fixing these lacunae? Not really, as these indicators are objective for all countries and by doing so we create a cleaner environment for business.

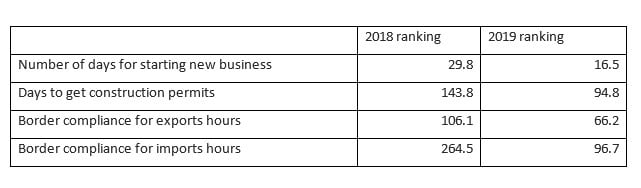

As can be seen in the table, by merely cutting down on the timelines for giving permission, one can make doing business easier. And the fact that the government has cut this down in a year’s time is indicative of how irrelevant the processes must have been which have come down over the ages and never be reviewed. Very often the paperwork involved in moving things with the bureaucracy is really tedious and adds to the cost.

How has our performance been? For starting a business, the rank has gone up from 156 to 137 which is very good. For dealing with construction permits it is up from 181 to 52 while the cost has reduced from 23 percent to 5.4 percent of warehouse value. This is a big gain for the industry. The cost of getting an electric connection is down from 97 percent to 30 percent which is again a big gain. And last, for registering property there has been deterioration in rank and score. The number of days has increased from 53 to 69. Surely, the government will work on this for the next round.

For the next two market parameters, India has done well again. For getting credit, the rank is up from 29 to 22 with a 100 percent credit bureau coverage which was just 43.5 percent earlier. There was virtually status quo in protecting minority shareholders though the score is high at 80 and it may be difficult to improve significantly on this.

On paying taxes, there is a surprise considering goods and services tax (GST) was to unclog the system. While the rank is down by two notches and payments to be made reduced marginally, the time taken for compliance is up from 214 to 275 hours. Clearly, the GST processes need to be reviewed if this variable is to be improved over time.

On the foreign trade side, significant gains have been made with the rank going up from 146 to 80, which bodes well for exporters in particular. The task is to ensure that the same changes are made across all major cities and states so that these benefits are made available to all traders.

The legal processes relating to enforcing contracts and insolvency have remained virtually unchanged or slipped marginally. It can be hoped that for the insolvency parameter, things will improve next year as the Insolvency and Bankruptcy Code (IBC) has started showing positive signs (data in this study is up to May 2018).

While the show is really impressive, the next question is what does this mean? Will investment increase? Here it must be pointed out that we need to distinguish between an increase in investment and the reduction in the cost of doing business.

Investment in the economy has been stagnant in the last three years and will depend on other factors such as capacity utilisation, cost of funds, bank willingness to lend, viable projects to be undertaken in infrastructure and so on.

But what this improvement in rank means is that the cost of doing business is lower now. For example, a person wanting to set up Rs 500 crore project spends less time in getting permits and is able to commence business, say 100 days earlier. The savings on interest on the loan taken will be significant. Policies are enablers and cannot drive investment by themselves.